Tech Focused India PE

India's High Growth Story

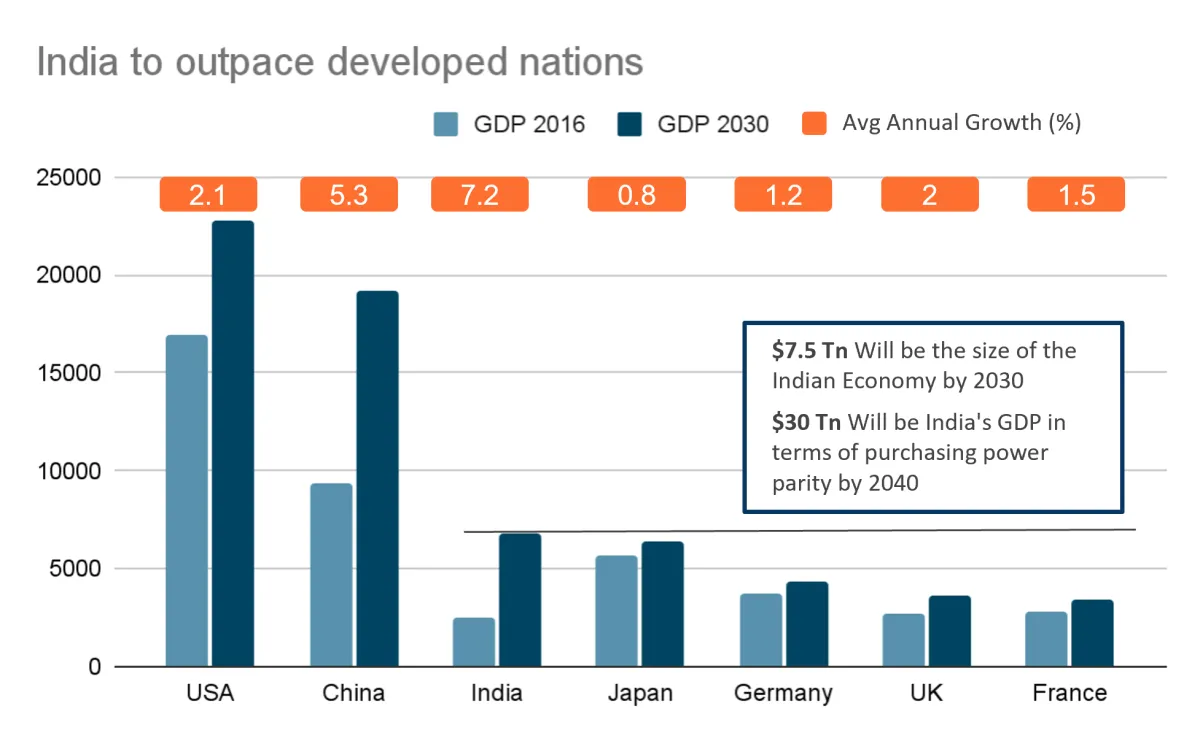

According to a Harvard study, India’s GDP growth will overtake its South Asian economic rival China.

It is also projected that India will achieve a highest annual GDP growth rate of a 7.2% to 7.9 % in the next eight years.

According to the report, outlooks for Europe and the US show little optimism.

The US growth rate is projected at 2.1%, while major European players range from 1.2% to 2.0%

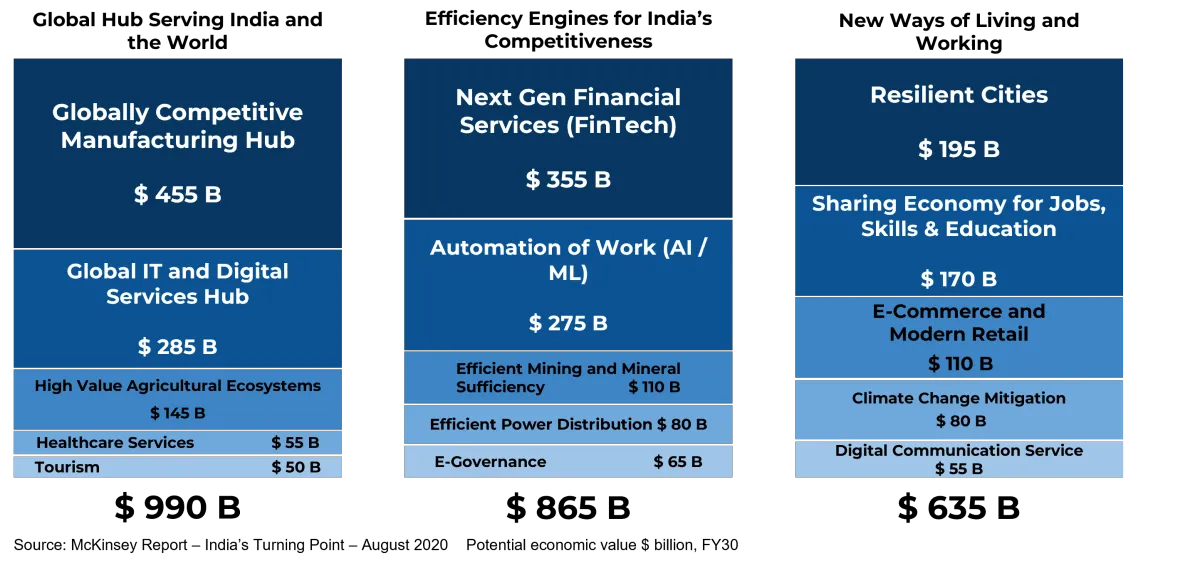

This growth will ensure that this is India's Golden Decade where India's Economy will more than double to $7.5T with a 5X growth in the Technology Sector - $1 T+ Tech Opportunity by the end of the decade

Interested in Investing in India - Listen to this speech by Mr. Deepak Bagla, CEO of Invest India

The four key trends favoring New India are

Demographics, Digitalization, Decarbonization, & Deglobalization.

India's Three Growth Boosters

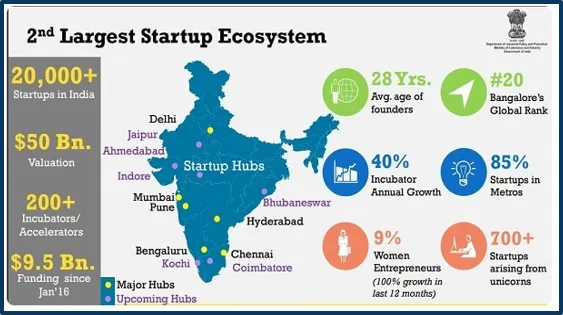

Startup Ecosystem in India

India is home to over 20,000+ startups, with their combined valuation reaching $50 Bn. To support the early-stage startups, there are 200+ incubators and accelerators and $ 9.5 B funding has been imparted since January 2016.

Indian Startup Ecosystem has seen exponential growth in the past few years (2015-2022):

• 15X increase in the total funding of startups

• 9X increase in the number of investors

• 7X increase in the number of incubators

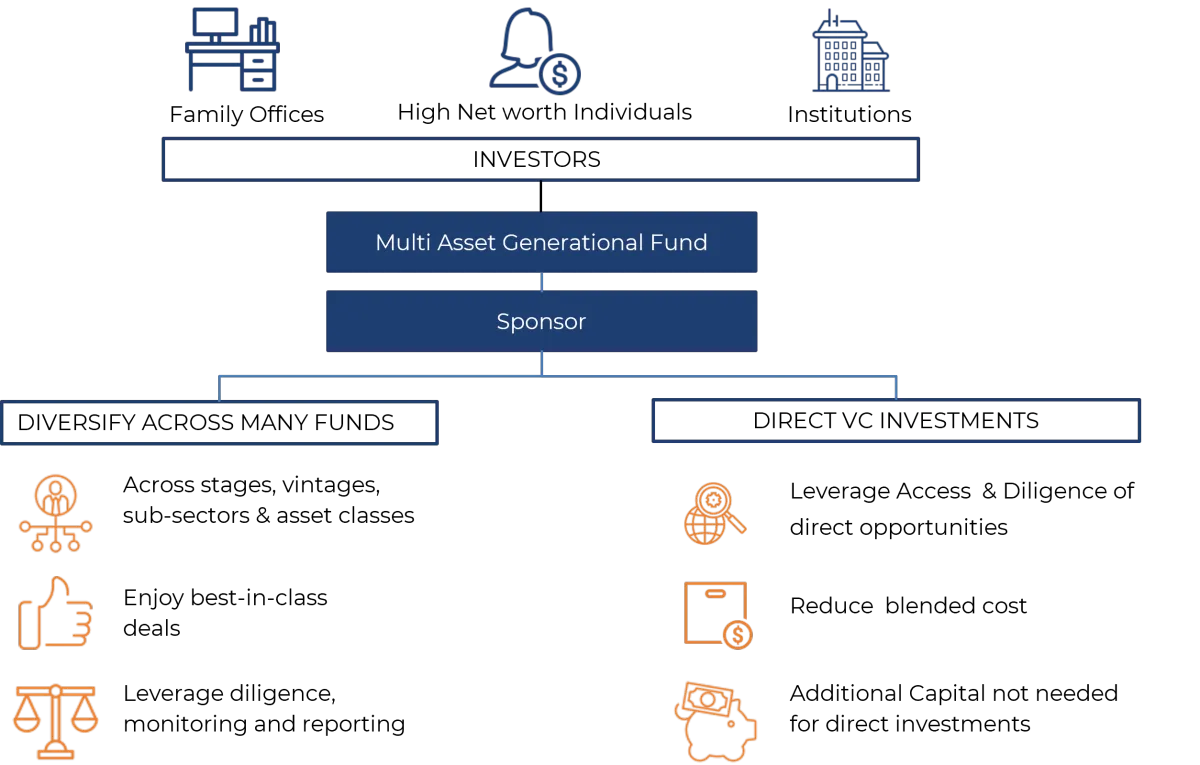

Multi Asset Generational (MAG) has partnered with SMK Ventures (Sponsor) to bring the opportunity to invest in Tech Focused Ventures in India

Our investment goal is to deliver high dollar normalized IRR through investing in top-tier, high-quality venture capital funds, direct co-investment opportunities, and other exclusive SPV opportunities.

We reduce the risk for our investors by investing across multiple funds which have a solid track record of performance, exceptionally high governance standard and a stringent due-diligence process

Investments will be diversified across 80-100 companies across tech verticals. The VC funds we invest in have high entry barriers restricted to very high ticket prices providing exclusivity.

(SMK Ventures Fund 1, LLC (Sponsor) is managed by SuMa Monde Kapital Ventures, LLC a Texas limited liability company (SMKV). The focus is to invest in technology companies and high-quality venture funds based in India. The goal is to provide access to a diversified pool of tech-based and tech-enabled companies while lowering entry barriers for global investors. SMKV will also target funds with exposure to diversified early-stage and growth-stage companies on track to be category leaders. The primary focus areas include Enterprise SaaS, FinTech, HealthTech, AI/ML, Web 3.0, Digital Content, and Direct-to-consumer(D2C). SMKV is an independent third-party sponsor with whom Multi Asset Generational, LLC (MAG) has partnered on a strategic basis. MAG or SMKV are not affiliated to each other in any other capacity)

Underlying Fund Fundamentals

Fund Highlights

US-based fund that through its partnership with the sponsor offers a platform approach to venture capital investments in the India growth story

The fund through will invest in a carefully curated portfolio of 80-100 companies

70-80% allocation to a diversified mix of Venture Capital Funds (diversified across early, growth, and late-stage funds -

Primary Funds: Commit to new funds

Follow-on Funds: Mitigate risk via a non-blind pool of assets in growth and late stage

Secondaries (Subject to availability): Acquire mature assets at a discount to intrinsic

20-30% allocation to direct deals available as co-investments into portfolio companies of the funds

Co-Invest in revenue-generating companies in growth and late stage

Invest mostly in the investee fund portfolio companies

Invest at the same terms as the investee fund

Fund Benefits

Access high-quality VC funds that are not available at smaller ticket sizes or those that don't raise non-institutional capital

Diversify your alternate allocation with lesser capital across sectors, fund managers, and company stages

Access the co-investment opportunities available with the above funds that are available at only higher investment ticket sizes

Institutional diligence in fund selection and institutional monitoring and operation management

Fund Strategy

Invest in 8-10 VC funds across:

Stages & Types (early stage, and growth stage)

Sectors (consumer, tech, deep tech, etc.)

Fund managers

Vintages

The fund will invest in direct deals through co-investments available with the above funds to maximize returns at lower costs

MAG Fund Terms

Proposed Raise: $5M

Fund Tenure: 10 Years from the date of initial investment. May be extended by up to 2 years at the fund manager's discretion.

Investment Period: 5 Years from the date of initial closing. May be extended by up to 12 months at the fund manager's discretion.

State Focus: Growth stage for maximizing ROI with risk management

Due-Diligence Fees: 1% of the invested amount

Asset Management Fees/Expenses: Not to exceed 1.5% per annum

Sponsors Skin in the Game: GP contribution is of at least 5% of the total proposed raise

Waterfall: 80% to the LPs, 20% to the GPs. No layered waterfall structures. LPs get 80% of what the sponsors payout.

Preferred Return: 8% preferred return to the investors

Minimum Investment: $100K (with multiple capital calls)

Max Exposure: Investment in a single entity at any time will not exceed 20% of investable funds

Principals and Sponsors

MAG Leadership

Akash Jain

General Partner

GP / LP / Asset Manager - Various RE and Startups

Serial Entrepreneur - multiple exits

Ex-Infosys, Cognizant, EY, Honeywell

SMK Ventures (Sponsor) Leadership

Suresh Vasvani

Founding Partner & Chairman - SMKV

Board member of PE-owned Tech sector companies

Board member on Vodafone Idea

Ex-Dell President, Wipro Co-CEO, IBM GM

Alumnus of IIM-A & IIT-KGP

Karan Negi

Founding Partner & CEO - SMKV

Sr. Founder and Managing Partner of Kriya Capital

Serial Entrepreneur

Successfully founded iValuate Global Technologies

21+ years of PE experience

Sudhir Pai

FOUNDING PARTNER & CFO - SMKV

Managing Partner of Legacy Wealth Planners, MyTimeEquity & SM Real Estate

CPA, FCA, EA and CGMA

Ex Co-Founder of MyTaxFiler & myStartupCFO

Ex AVP of Infosys Technologies

Vishwesh Pai

FOUNDING PARTNER & COO - SMKV

Worked in ServiceNow, Amazon, and Samsung

Investor in 20+ tech companies, 3 IPO exits

Alumnus of UC Berkeley Haas and NCSU

(Akash Jain is the principal and manager of MAG, Suresh Vasvani, Karan Negi, Sudhir Pai, and Vishwesh Pai are managers and members of SMKV, an independent third-party sponsor with whom MAG has partnered on a strategic basis. MAG or SMKV are not affiliated to each other in any other capacity)

Fund Structure

Investment & Due Diligence Process

1. Deal Origination

Referrals from Founders, Business Partners, Funds & Companies already invested in, and Service providers

Networking - Access to Startup Events, and Meeting Founders

Online Engagement - LinkedIn Articles, Webinar panels, and Social media presence

2. Screening

Deals are categorized under certain criteria based on market scope, technology, product, and size of investment stage of financing

Entrepreneurs and Fund managers are asked to provide their Profile, Market Scope, Financial models and Face to Face meeting happens seeking all clarifications

3. Evaluation

The process of evaluation is a thorough process in which we not only evaluate the financials, the cap table and the product scalability but also the capacity of entrepreneurs and fund managers to meet any claims made

Key considerations during evaluation is an assessment of entrepreneur w.r.t skills such as entrepreneurial skills, technical competence, and experience

4. Deal Negotiation

In this stage of the deal, the terms and conditions of the deal are formulated to ensure they are mutually beneficial

Some of the factors which are negotiated are the amount of investment, reduction in any associated fee, board member seat, advisory positions, terms for follow-on rounds, etc.

In this stage of the deal, the terms and conditions of the deal are formulated to ensure they are mutually beneficial

Some of the factors which are negotiated are the amount of investment, reduction in any associated fee, board member seat, advisory positions, terms for follow-on rounds, etc.

5. Post Investment Activity

Participate in the company by representation on the Board to ensure that the company is acting as per the plan,

Analyze newsletters, monitor budgeted vs. actual financials, seek any clarifications periodically, and monitor the progress of the investment in terms of valuations, etc.

6. Exit Plan

Ensures we make minimal losses and maximum profits

Exit through IPOs

Acquisition by another strategic or competition

Secondary Sale of Shares

Multi-Asset Generational is a diversified private equity

fund that enables passive income and generational

wealth-building strategies.

The fund invests in varies asset classes inclusive of real estate, tech-focused startups, and other alternative investment classes. To learn more about our investment strategy, our asset selection criteria as well as our due diligence process, book an appointment with our leadership team.

HOURS:

Mon – Fri

8:00 AM – 5:00 PM CST

CONTACT NO.:

STAY IN TOUCH

© 2025 Multi-Asset Generational

All material presented herein is intended for information purposes only.